In the South, Bankruptcy is Different, Especially for Black Debtors

For consumers, there are two main options under federal bankruptcy law: Chapter 7, which wipes away most debts, or Chapter 13, which usually requires five years of payments before debts are forgiven. In most of the country, people choose Chapter 7. But two overlapping groups — debtors in the South and black debtors — disproportionately file under Chapter 13. About half of Chapter 13 cases are dismissed, usually because debtors failed to make their payments. This can leave them worse off than before they filed because they’ve paid court costs and attorney fees while falling further behind on their debts. Detailed Findings | Related Story | Download the Data

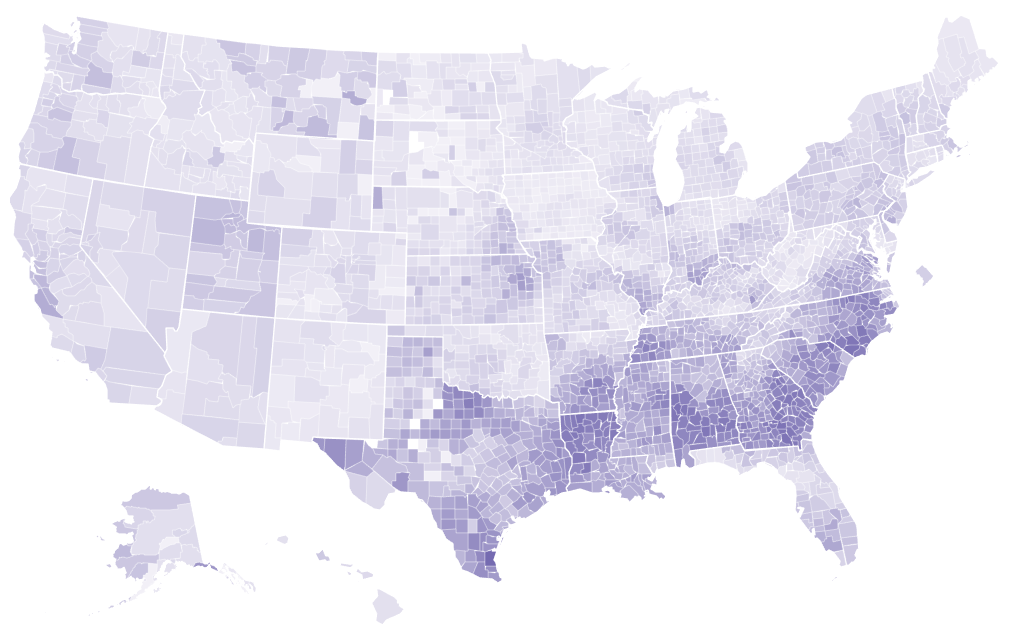

Hover over each county to see the percentage of bankruptcy filings that were filed under Chapter 13 there.

Percentage of bankruptcy cases filed under Chapter 13, 2008-2015

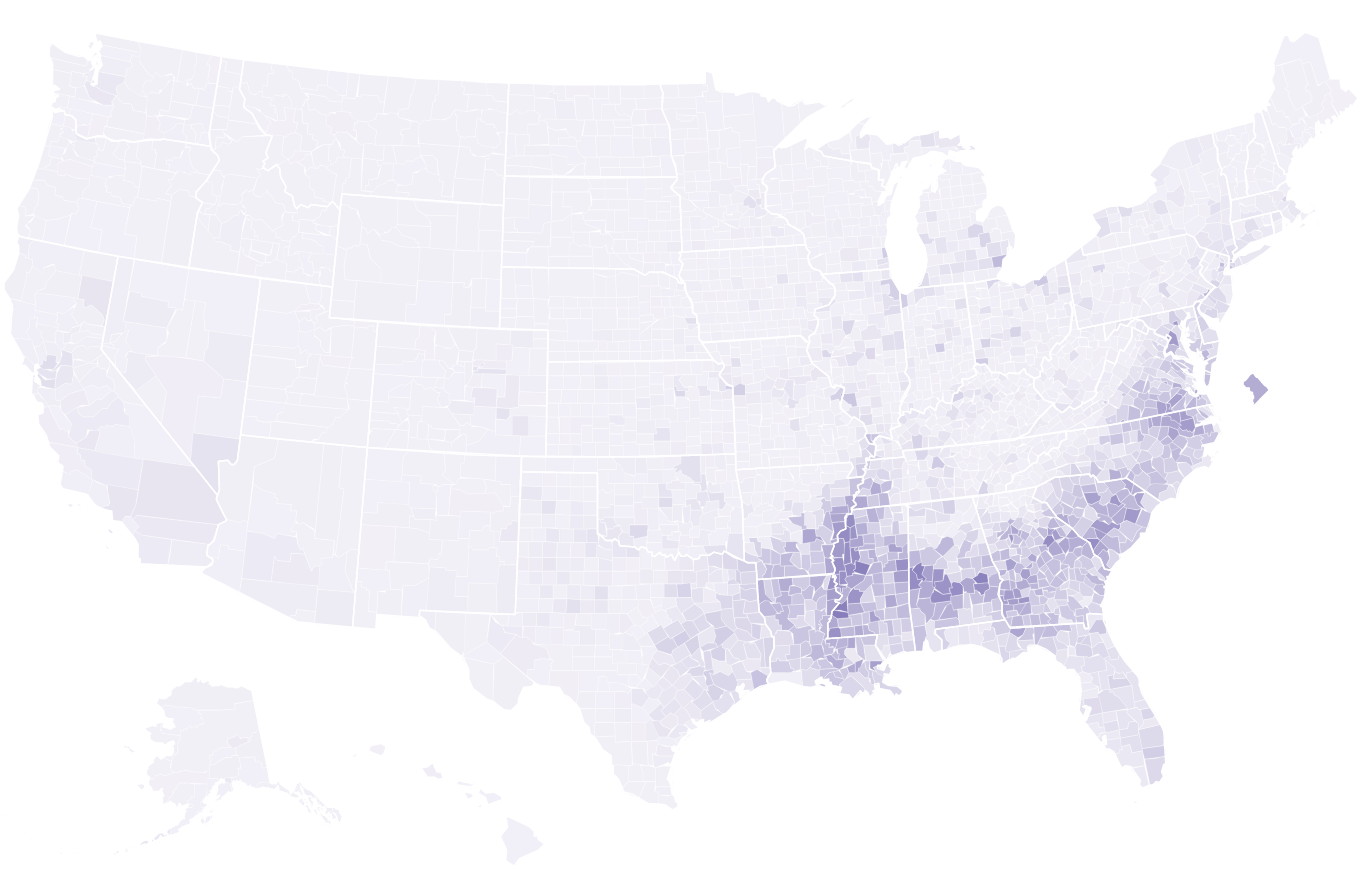

Percentage of bankruptcy cases filed under Chapter 13, 2008-2015

Percentage of bankruptcy cases filed under Chapter 13, 2008-2015

Black Population by County, 2010

Nationally, more than half of filers from majority black areas use Chapter 13, compared to about 25 percent who live in majority white areas. Even controlling for court district, income, and other financial characteristics, filers in majority black areas are more likely than those in white areas to use Chapter 13. And black debtors are more likely to fail their plans and have their cases dismissed, missing out on lasting debt relief.

Chapter 13 can be the better choice in some circumstances. For debtors who have fallen behind on secured debts like a car loan or a mortgage, Chapter 13 provides an opportunity to catch up on payments over time without the danger of repossession or foreclosure. However, many debtors who choose Chapter 13 don’t own a home.

Chapter 13 is far more prevalent in the South. This is due, in part, to how attorneys are paid. Many attorneys in the South offer low- or no-money-down payment plans to cover legal fees in Chapter 13 cases, making Chapter 13 seem, at least in the short term, more affordable for low-income debtors than Chapter 7. For a more in-depth discussion of possible reasons for the popularity of Chapter 13, see our main story and detailed analysis.

Source: ProPublica analysis of U.S. Bankruptcy Court data from 2008 to 2015 and 2010 Census data. Our analysis includes only consumer cases that originated in Chapters 7 or 13.