Positions

Positions are those where a justice was an officer, director, trustee, partner, proprietor, representative, employee or consultant for any organization other than the U.S. government at the time the disclosure was filed.

| Report Year | Organization | Title |

|---|---|---|

| 2010 | Harvard University | Lecturer |

| 2010 | American Bar Association | Ex officio member, section of administrative law and regulatory practice |

| 2010 | Edward Coke Appellate Inn of Court | Vice president and president-elect |

| 2010 | Historical Society of the District of Columbia Circuit | Director |

Agreements

Agreements include any agreements into which a justice has entered, such as employment contracts, continuing payments from former employers and continuing participation in employee welfare or benefit plans maintained by a former employer.

| Year | Organization | Terms |

|---|---|---|

| 2011 | Yale University | Teaching in 2011 |

| 2011 | Harvard University | Teaching in 2012 |

Noninvestment income

Noninvestment income includes compensation from jobs the justice has had, such as teaching roles; jobs at law firms before they were judges; pension benefits; and royalties for intellectual property, such as books and copyrights.

| Date/Year | Organization Name | Amount | Purpose |

|---|---|---|---|

| 2010 | Harvard University | $22,512.75 | Teaching |

Spousal income

Spousal income includes earned income from jobs a justice’s spouse has held, as well as honoraria. Justices are required to report a spouse’s income that exceeded $1,000 but are not required to disclose specific amounts.

| Source | Description | Amount |

|---|---|---|

| George W. Bush Presidential Center | Salary |

Travel Reimbursements

Reimbursements include any payment or thing of value received to cover travel-related expenses for justices and their families. They can include expenses that the third party paid directly or for which a justice paid upfront and was reimbursed, but justices are not required to report reimbursements’ dollar values. Show more.

undefined

undefined

| Date | Source | Location | Purpose | Items Paid or Provided |

|---|---|---|---|---|

| Oct. 8 – 9, 2010 | Yale University | New Haven, CT |

Speaking

Speak on panel at reunion |

Food, Lodging, Transportation |

| April 15 – 16, 2010 | Yale Law Journal | New Haven, CT |

Speaking

Speak at annual banquet |

Food, Lodging, Transportation |

| April 14 – 15, 2010 | Columbia University | New York, NY |

Teaching

Speak to class at Columbia Law School |

Food, Lodging, Transportation |

| April 13 – 14, 2010 | New York University | New York, NY |

Moot Court

Moot court |

Food, Lodging, Transportation |

| March 23 – 24, 2010 | Yale University | New Haven, CT |

Speaking

Speak on panel at Yale Law School |

Food, Lodging, Transportation |

| March 19 – 22, 2010 | Pepperdine University | Malibu, CA |

Speaking

Lecture to future federal law clerks at Judicial Clerkship Institute |

Food, Lodging, Transportation |

| Jan. 4 – 22, 2010 | Harvard University | Cambridge, MA | Teaching | Food, Lodging, Transportation |

Gifts

Gifts include gifts received by justices, their spouses or their dependent children from any source other than a relative. Justices are only required to disclose gifts whose aggregate value from the same source exceeds a certain threshold ($480 in 2023) within the reporting period and gifts that are individually worth more than 40% of that threshold. This only captures gifts that have been disclosed, which ProPublica reporting shows can be incomplete. Show more.

No gifts

Liabilities

Liabilities include debts that exceeded $10,000 at any time during the reporting period for justices, their spouses or their dependent children. Because justices have to report these each year, some debts may show up multiple times in the table. Show more.

| Creditor | Description | Value |

|---|---|---|

| Bank of America | Credit card | $0 – $15,000 |

| JPMorgan Chase & Co. | Credit card | $0 – $15,000 |

| USAA | Credit card | $0 – $15,000 |

| Thrift Savings Plan | Loan | $15,001 – $50,000 |

Investments

Investments include cash accounts, property, stocks, investment funds, retirement plans and other financial instruments owned by justices, their spouses and dependent children in excess of certain value thresholds or generating more than $200 in income in a year. Justices are not required to disclose information about their personal residences unless they generate rental income.

ProPublica has not extracted investments data for 2010. For information about Brett Kavanaugh’s investments, view the filing.

Additional Information or Explanations

Additional information or explanations include a justice’s explanatory comments clarifying other portions of the report. These may include explanations of apparent inconsistencies with previous reports, third-party opinions on possible conflicts of interest or other supporting documentation.

Part IV Reimbursements (Continued):

Yale Law Journal April 15-16, 2010 New Haven, CT Speak at annual banquet Transportation, lodging, meals

Yale Law School October 8-9, 2010 New Haven, CT Speak on panel at reunion Transportation, lodging, meals

Part VII

Added Insperity 401(k) from) █████ employment.

About The Data

The bulk of the data we used came from the Free Law Project, which maintains a database of more than 35,000 financial disclosure records for federal judges, justices and magistrates, most of it dating back to 2003. These disclosures, which federal employees are required to file each year under the Ethics in Government Act of 1978, are maintained by the Administrative Office of the U.S. Courts. The law, however, requires most of them to be destroyed after six years, making many disclosures from earlier years hard to find. Our disclosures cover most of those filed since 2003, as well as some financial information disclosed by some justices during their Senate confirmations in 1990, 1991 and 2000. Our database also includes eight of Clarence Thomas’ disclosures from 1992 to 1999 provided by Documented. (Do you have information about a Supreme Court justice’s finances from before 2003? Email us.)

Because much of the data was extracted from PDFs using optical character recognition, we designed our own database and imported and cleaned the Free Law Project’s data to fix scanning and other errors. We corrected spelling errors, edited fields for style and clarity and, where possible, attempted to add contextual information by, for example, categorizing organizations and transactions, standardizing certain fields, updating entity names or filling in missing information.

In some cases, such as when the Free Law Project did not have a specific disclosure or had not extracted data from a report, we extracted or transcribed the data manually.

After cleaning and standardizing the data, we spot-checked it for accuracy, looking primarily for transcription or categorization errors. If you believe you see an error in the database, please contact us at [email protected].

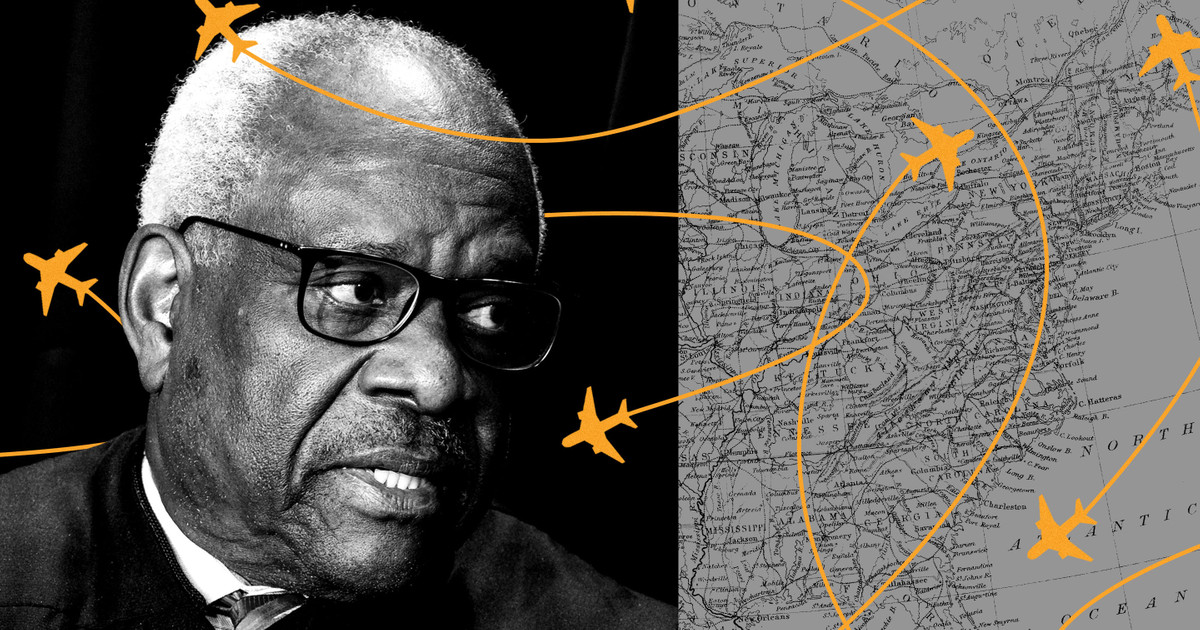

More from Friends of the Court

ProPublica has reported that justices have sometimes failed to disclose speaking engagements and gifts like private jet travel and luxury vacations from wealthy and influential people. Read our series: Friends of the Court.

Do you have any tips on the courts? Contact us securely or reach out to ProPublica reporters Justin Elliott and Josh Kaplan.

-

Alito Took Unreported Luxury Trip With GOP Donor Paul Singer

In the years after the undisclosed trip to Alaska, Republican megadonor Paul Singer’s hedge fund has repeatedly had business before the Supreme Court. Alito has never recused himself.

-

The Other Billionaires Who Helped Clarence Thomas Live a Luxe Life

The fullest accounting yet shows how Thomas has secretly reaped the benefits from a network of wealthy and well-connected patrons that is far more extensive than previously understood.

-

Supreme Court Adopts Its First-Ever Ethics Code

Experts say it is unclear if the new rules, which come after reporting by ProPublica and others revealed that justices had repeatedly failed to disclose gifts and travel from wealthy donors, would address the issues raised by the recent revelations.