Positions

Positions are those where a justice was an officer, director, trustee, partner, proprietor, representative, employee or consultant for any organization other than the U.S. government at the time the disclosure was filed.

| Report Year | Organization | Title |

|---|---|---|

| 2022 | Horatio Alger Association | Board of directors |

Agreements

Agreements include any agreements into which a justice has entered, such as employment contracts, continuing payments from former employers and continuing participation in employee welfare or benefit plans maintained by a former employer.

No agreements

Noninvestment income

Noninvestment income includes compensation from jobs the justice has had, such as teaching roles; jobs at law firms before they were judges; pension benefits; and royalties for intellectual property, such as books and copyrights.

| Date/Year | Organization Name | Amount | Purpose |

|---|---|---|---|

| Dec. 20, 2022 | George Mason University | $12,000.00 | Academic - Other |

Spousal income

Spousal income includes earned income from jobs a justice’s spouse has held, as well as honoraria. Justices are required to report a spouse’s income that exceeded $1,000 but are not required to disclose specific amounts.

| Source | Description | Amount |

|---|---|---|

| Liberty Consulting | Salary and benefits |

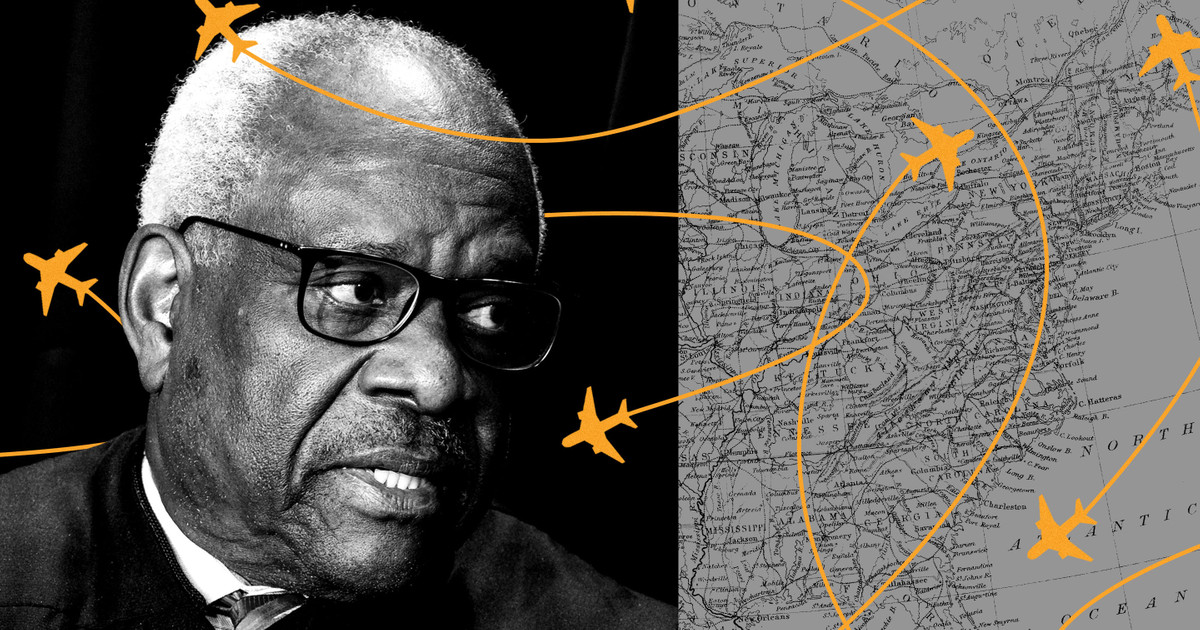

Travel Reimbursements

Reimbursements include any payment or thing of value received to cover travel-related expenses for justices and their families. They can include expenses that the third party paid directly or for which a justice paid upfront and was reimbursed, but justices are not required to report reimbursements’ dollar values. Show more.

undefined

undefined

| Date | Source | Location | Purpose | Items Paid or Provided |

|---|---|---|---|---|

| July 7 – 13, 2022 | Harlan Crow | Keese Mill, NY |

Other

Guests of source |

Food, Lodging, Transportation |

| May 12 – 14, 2022 | Harlan Crow | Dallas, TX |

Speaking

Keynote speaker at American Enterprise Institute’s Conference at Old Parkland |

Food, Transportation |

| March 10 – 12, 2022 | Orrin G. Hatch Foundation | Salt Lake City, UT |

Speaking

Featured speaker |

Food, Lodging, Transportation |

| Feb. 3 – 5, 2022 | Harlan Crow | Dallas, TX |

Speaking

Keynote speaker at American Enterprise Institute’s Conference at Old Parkland |

Food, Private Flight, Transportation |

Gifts

Gifts include gifts received by justices, their spouses or their dependent children from any source other than a relative. Justices are only required to disclose gifts whose aggregate value from the same source exceeds a certain threshold ($480 in 2023) within the reporting period and gifts that are individually worth more than 40% of that threshold. This only captures gifts that have been disclosed, which ProPublica reporting shows can be incomplete. Show more.

No gifts

Liabilities

Liabilities include debts that exceeded $10,000 at any time during the reporting period for justices, their spouses or their dependent children. Because justices have to report these each year, some debts may show up multiple times in the table. Show more.

No liabilities

Investments

Investments include cash accounts, property, stocks, investment funds, retirement plans and other financial instruments owned by justices, their spouses and dependent children in excess of certain value thresholds or generating more than $200 in income in a year. Justices are not required to disclose information about their personal residences unless they generate rental income.

All Investment Holdings: $1.2M – $2.7M

| Name | Category | Income Amount | Income Type | Gross Value Amount | Gross Value Method | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Ginger Holdings

|

Real Estate | $50,001 – $100,000 | Rent | $500,001 – $1,000,000 | Estimated | ||||||||

70% S&P 500 Index account

|

Other | $1,001 – $2,500 | Dividend | $50,001 – $100,000 | Cash Market | ||||||||

Vanguard Small Cap Value Index Fund Admiral Shares

(VSIAX

)

|

Retirement Fund | $1,001 – $2,500 | Dividend | $50,001 – $100,000 | Cash Market | ||||||||

Vanguard Value Index Fund Admiral Shares

(VVIAX

)

Show Transactions (1)

Hide Transactions

|

Retirement Fund | $1,001 – $2,500 | Dividend | $50,001 – $100,000 | Cash Market | ||||||||

Vanguard Wellington Fund Admiral Shares

(VWENX

)

Show Transactions (1)

Hide Transactions

|

Retirement Fund | $1,001 – $2,500 | Dividend | $50,001 – $100,000 | Cash Market | ||||||||

CenterState Bank CD

|

Retirement Fund | $0 – $1,000 | Interest | $50,001 – $100,000 | Cash Market | ||||||||

30% guaranteed account

|

Other | $0 – $1,000 | Interest | $15,001 – $50,000 | Cash Market | ||||||||

Vanguard Emerging Markets Stock Index Fund Admiral Shares

(VEMAX

)

|

Retirement Fund | $0 – $1,000 | Dividend | $15,001 – $50,000 | Cash Market | ||||||||

Vanguard Health Care Fund Investor Shares

(VGHCX

)

|

Retirement Fund | $1,001 – $2,500 | Dividend | $15,001 – $50,000 | Cash Market | ||||||||

Vanguard Total International Stock Index Fund Admiral Shares

(VTIAX

)

|

Retirement Fund | $0 – $1,000 | Dividend | $15,001 – $50,000 | Cash Market | ||||||||

AXA Universal Life Policy

|

Life Insurance | $5,001 – $15,000 | Dividend | $100,001 – $250,000 | Cash Market | ||||||||

Congressional Federal Credit Union accounts

|

Cash Account | $0 – $1,000 | Interest | $100,001 – $250,000 | Cash Market | ||||||||

Vanguard 500 Index Fund Admiral Shares

(VFIAX

)

Show Transactions (1)

Hide Transactions

|

Retirement Fund | $1,001 – $2,500 | Dividend | $100,001 – $250,000 | Cash Market | ||||||||

Vanguard Wellesley Income Fund Admiral Shares

(VWIAX

)

Show Transactions (1)

Hide Transactions

|

Retirement Fund | $5,001 – $15,000 | Dividend | $100,001 – $250,000 | Cash Market | ||||||||

Wells Fargo IRA CD

|

Retirement Fund | $0 – $1,000 | Interest | $0 – $15,000 | Cash Market |

Additional Information or Explanations

Additional information or explanations include a justice’s explanatory comments clarifying other portions of the report. These may include explanations of apparent inconsistencies with previous reports, third-party opinions on possible conflicts of interest or other supporting documentation.

During the preparation and filing of this report, filer sought and received guidance from the Supreme Court’s Legal Office, the Counselor to the Chief Justice, the staff of the Judicial Conference Financial Disclosure Committee (“Committee”), and personal counsel. Filer continues to work with Supreme Court officials and the Committee staff for guidance on whether he should further amend his reports from any prior years. Based on those discussions, the information below addresses the new travel disclosure requirements which began coverage with calendar year 2022, personal bank accounts and his spouse’s life insurance that were inadvertently omitted from prior reports for the covered period 2017 thru 2021, mistaken name of spouse’s family real estate holding, and a real estate transaction that predated the covered period.

TRAVEL

As relates to the personal hospitality reporting exemption, filer has included all reportable travel on his Calendar Year 2022 Report, in accordance with the new rules that went into effect on March 14, 2023, as advised by the Supreme Court’s Legal Office, the Counselor to the Chief Justice, the staff of the Judicial Conference Financial Disclosure Committee, and personal counsel.

On March 14, 2023, the Judicial Conference provided new guidance on the “personal hospitality” exemption to explicitly state for the first time that “transportation that substitutes for commercial transportation” will no longer be considered exempt from reporting under that provision. As a result, filer will report any such trips, beginning with this filing for calendar year 2022.

Prior to the March 14, 2023 guidance, filer adhered to the then existing judicial regulations as his colleagues had done, both in practice and in consultation with the Judicial Conference, that exempted disclosing trips that were provided pursuant to the “personal hospitality” exemption, as set forth in the statute and rules. As far back as the 1984 Judicial Conference guidance, under the section titled, “Gifts of transportation, lodging, food, or entertainment,” filers were instructed to:

Exclude gifts received as the personal hospitality of any individual. The Act defines ‘personal hospitality of any individual’ as ‘hospitality extended for a non-business purpose by an individual, not a corporation or an organization, at the personal residence of that individual or his family or on property or facilities owned by that individual or his family.

Guide to Judiciary Policies and Procedures (1984) at 843-44.

The Judicial Conference, which is charged by the Ethics in Government Act, 5 U.S.C. app. §§ 13101-13111, with implementing this law for the judiciary, has provided written guidance through its regulations and advice interpreting the statute that such travel need not be reported. In fact, filer is not aware of anything in the Judicial Conference regulations issued for more than thirty years or in any advice provided by the Judicial Conference to judges that is inconsistent with this position.

For example, Judge Raymond Randolph, who served on the Judicial Conference Codes of Conduct Committee from 1992-98, including as chairman from 1995-98, received guidance in 2006 from Judicial Conference staff, as reflected in contemporaneous notes, that he did not have to report travel on a private jet and at a lodge based on the personal hospitality exemption. Filer was also so advised by Conference staff, and in conversations with court officers and colleagues early in his tenure on the Court.

In Part IV, Line 3: With advice of the Administrative Office, flights were reported as advised. Because of the increased security risk following the Dobbs opinion leak, the May flights were by private plane for official travel as filer’s security detail recommended noncommercial travel whenever possible.

In Part IV, Line 4: Flights to and from Adirondacks by private plane and lodging, food, and entertainment at the Adirondacks property, were reportable under and in compliance with the new guidance and, according to advice from the staff of the Judicial Conference Financial Disclosure Committee (July 10), to be listed under “reimbursements” not “gifts.” This is consistent with previous filings by other filers.

BANK ACCOUNTS, SPOUSE'S LIFE INSURANCE, & FAMILY REAL ESTATE HOLDING

2022: Part VII, Line 3: Life insurance policy, owned by spouse, was inadvertently omitted from prior reports during the covered period. Part VII, Line 7: On or around February 17, 2006, Ginger LTD, Partnership changed its legal name to its present name of Ginger Holdings LLC. The name change was in conjunction with a conversion to an LLC from a limited partnership as permitted under Nebraska state law. Due to the similarity in names, filer inadvertently carried the old name on prior reports during the covered period. Part VII, Line 8: Personal bank accounts at Congressional Federal Credit Union were inadvertently omitted in prior years due to a misinterpretation of the rules. Filer believed that personal bank accounts were exempt from reporting disclosure.

Filer discloses the following assets that were inadvertently omitted from his reports during the covered period 2017 thru 2021:

2021: Bank accounts at Congressional Federal Credit Union were inadvertently omitted. Combined bank account balances at year-end were under $55,000 and earned less than $200 in interest. Life insurance policy of spouse held through Equitable was inadvertently omitted. Year-end cash value was under $100,000 and earned $5,000 or less in income.

2020: Bank accounts at Congressional Federal Credit Union were inadvertently omitted. Combined bank account balances at year-end were under $110,000 and earned less than $400 in interest. Life insurance policy of spouse held through Equitable was inadvertently omitted. Year-end cash value was under $100,000 and earned $2,500 or less in income.

2019: Bank accounts at Congressional Federal Credit Union were inadvertently omitted. Combined bank account balances at year-end were under $50,000 and earned less than $400 in interest. Life insurance policy of spouse held through Equitable was inadvertently omitted. Year-end cash value was under $100,000 and earned $2,500 or less in income. The policy at Equitable had previously been held at MONY Life Insurance Company of America but was terminated on or around December 16, 2019, and rolled over into Equitable in a tax-free exchange under Internal Revenue Code §1035. Prior to the rollover, the MONY Life Insurance Company of America life insurance policy had a cash value of under $100,000 and earned $2,500 or less in income.

2018: Bank accounts at Congressional Federal Credit Union were inadvertently omitted. Combined bank account balances at year-end were under $70,000 and earned less than $300 in interest. Life insurance policy of spouse held through MONY Life Insurance Company of America was inadvertently omitted. Year-end cash value was under $100,000 and earned $2,500 or less in income.

2017: Bank accounts at Congressional Federal Credit Union were inadvertently omitted. Combined bank account balances at year-end were under $10,000 and earned less than $300 in interest. Life insurance policy of spouse held through MONY Life Insurance Company of America was inadvertently omitted. Year-end cash value was under $100,000 and earned $2,500 or less in income.

SAVANNAH REAL ESTATE TRANSACTION

Although outside the covered period, filer provides the following supplemental information regarding the 2014 disposition of certain real estate interests he held with members of his family in Savannah, Georgia. In 1984, filer inherited a 1/3 interest in three properties: his mother’s residence and two additional houses on the same street.

In 2014, Mr. Harlan Crow, a longtime friend of filer and his wife, bought all three properties for $133,000, along with other houses/lots on the same street. Filer and his wife had put between $50,000 to $75,000 into his mother’s home in capital improvements over the years, and therefore, the transaction amounted to a capital loss.

Filer had previously reported his interest in two of the Savannah properties (excluding his mother’s residence) in the years when they generated rental income. Once these properties no longer generated any rental income, filer was advised by Committee staff to remove the two properties from his disclosure forms. However, filer inadvertently failed to realize that the “sales transaction” for the final disposition of the three properties triggered a new reportable transaction in 2014, even though this sale resulted in a capital loss.

About The Data

The bulk of the data we used came from the Free Law Project, which maintains a database of more than 35,000 financial disclosure records for federal judges, justices and magistrates, most of it dating back to 2003. These disclosures, which federal employees are required to file each year under the Ethics in Government Act of 1978, are maintained by the Administrative Office of the U.S. Courts. The law, however, requires most of them to be destroyed after six years, making many disclosures from earlier years hard to find. Our disclosures cover most of those filed since 2003, as well as some financial information disclosed by some justices during their Senate confirmations in 1990, 1991 and 2000. Our database also includes eight of Clarence Thomas’ disclosures from 1992 to 1999 provided by Documented. (Do you have information about a Supreme Court justice’s finances from before 2003? Email us.)

Because much of the data was extracted from PDFs using optical character recognition, we designed our own database and imported and cleaned the Free Law Project’s data to fix scanning and other errors. We corrected spelling errors, edited fields for style and clarity and, where possible, attempted to add contextual information by, for example, categorizing organizations and transactions, standardizing certain fields, updating entity names or filling in missing information.

In some cases, such as when the Free Law Project did not have a specific disclosure or had not extracted data from a report, we extracted or transcribed the data manually.

After cleaning and standardizing the data, we spot-checked it for accuracy, looking primarily for transcription or categorization errors. If you believe you see an error in the database, please contact us at [email protected].

More from Friends of the Court

ProPublica has reported that justices have sometimes failed to disclose speaking engagements and gifts like private jet travel and luxury vacations from wealthy and influential people. Read our series: Friends of the Court.

Do you have any tips on the courts? Contact us securely or reach out to ProPublica reporters Justin Elliott and Josh Kaplan.

-

Alito Took Unreported Luxury Trip With GOP Donor Paul Singer

In the years after the undisclosed trip to Alaska, Republican megadonor Paul Singer’s hedge fund has repeatedly had business before the Supreme Court. Alito has never recused himself.

-

The Other Billionaires Who Helped Clarence Thomas Live a Luxe Life

The fullest accounting yet shows how Thomas has secretly reaped the benefits from a network of wealthy and well-connected patrons that is far more extensive than previously understood.

-

Supreme Court Adopts Its First-Ever Ethics Code

Experts say it is unclear if the new rules, which come after reporting by ProPublica and others revealed that justices had repeatedly failed to disclose gifts and travel from wealthy donors, would address the issues raised by the recent revelations.